Sometimes, sticking with the same insurance broker can feel like wearing an old pair of shoes—comfortable but not necessarily the best fit anymore. Changing insurance brokers might sound like a hassle, but it can make a world of difference in your coverage, costs, and overall experience. If you’ve been wondering if it’s time to make the switch, you’re not alone. Many people and businesses make this move to get better service, lower premiums, or simply a broker who understands their needs better.

Signs It’s Time for Changing Insurance Brokers

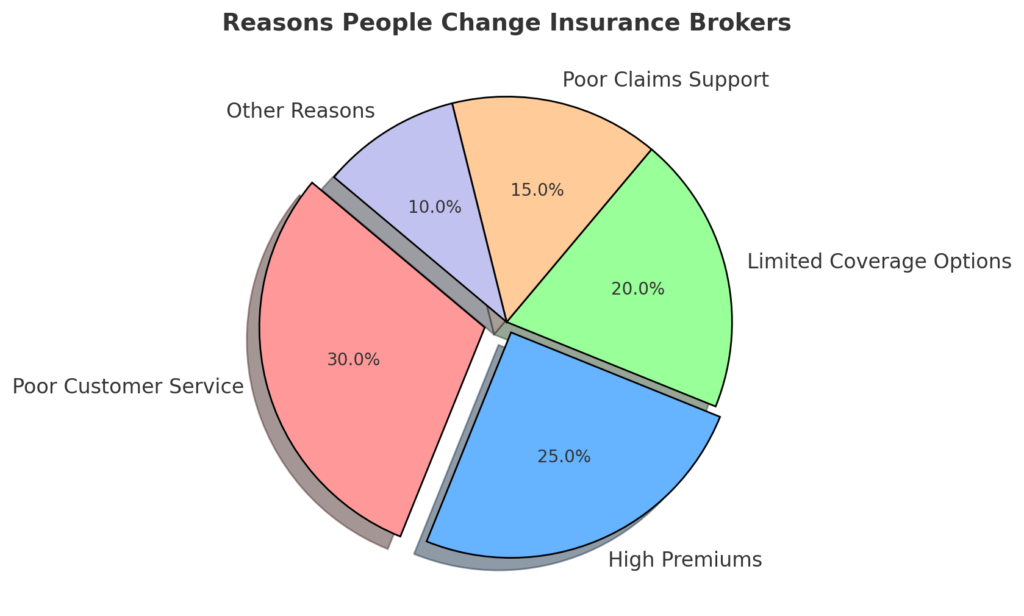

Not all brokers are created equal, and sometimes, staying loyal can cost you. Here are some clear signs that you should think about making a change:

1. Lack of Communication

A great broker keeps you informed, answers your questions promptly, and ensures you understand your policy. If your current broker rarely responds, provides vague answers, or seems uninterested in helping, it’s a red flag. Changing insurance brokers could mean getting the attentive service you deserve.

2. Your Premiums Keep Rising Without Explanation

Insurance rates fluctuate, but if your premiums keep going up and your broker isn’t giving you a clear reason—or better yet, looking for alternatives—it’s time to question their effort. A proactive broker should shop around for better rates and explain price changes.

3. Poor Claim Support

Filing an insurance claim should be smooth, but some brokers disappear when you need them the most. If you’ve had issues with slow claims processing, lack of guidance, or disputes with your insurer, you might be better off changing insurance brokers who actually stand by your side.

4. You Feel Like Just Another Client

A good broker takes the time to understand your specific needs. If they treat you like just another number in their system and don’t bother checking if your policy still fits your life or business, it might be time for someone who actually listens.

5. Limited Coverage Options

Some brokers only work with a handful of insurance companies, meaning your choices are limited. Changing insurance brokers to someone with access to a wider range of providers could open up better coverage options at more competitive rates.

Benefits of Changing Insurance Brokers

Switching to a new insurance broker might seem like a hassle, but the advantages far outweigh the effort involved. The right broker can provide better pricing, more tailored policies, and a higher level of service that meets your needs. Many people stick with the same broker for years out of habit, but this can lead to missed opportunities for cost savings and better coverage.

A fresh perspective can bring a wealth of new options to the table. A new broker might have access to a wider range of insurance providers, better industry connections, and a more proactive approach to managing your policies. Insurance is a major financial decision, and having the right broker can mean the difference between being well-protected and overpaying for coverage you don’t need.

If you’re on the fence about changing insurance brokers, consider the following benefits that come with making the switch.

Access to More Competitive Pricing

One of the biggest reasons to consider a new broker is cost. Insurance rates fluctuate, and different brokers have access to different insurance providers. A new broker can shop around and compare policies to find better pricing that suits your budget without sacrificing coverage.

A good broker should be working for you, not the insurance company. If your current broker hasn’t been proactive in finding ways to lower your costs or optimize your coverage, you could be missing out on significant savings. The insurance industry is highly competitive, and a skilled broker knows how to negotiate lower rates, bundle policies, and recommend cost-effective alternatives.

Improved Policy Customization

Insurance is not a one-size-fits-all situation. The right broker will tailor a policy specifically to your needs, whether you’re an individual, a small business owner, or managing multiple properties. A fresh start with a new broker could mean better customization, ensuring that you’re neither underinsured nor paying for coverage you don’t need.

Some brokers work with a limited number of insurance providers, which means they might not be offering you the best possible options. Changing insurance brokers allows you to work with someone who can provide a wider variety of policies that align with your current circumstances.

Proactive Risk Management Advice

A great broker does more than just sell insurance—they help you manage risks. Whether you’re looking for business insurance, home coverage, or auto protection, a proactive broker will analyze potential risks and recommend strategies to minimize them.

For example, a knowledgeable broker may suggest:

- Adjusting your policy to include additional coverage for emerging risks.

- Offering guidance on reducing liabilities in your home or business.

- Helping you take advantage of discounts for safety features or bundling policies.

If your current broker isn’t providing this type of forward-thinking advice, changing insurance brokers could be the smartest move.

More Responsive and Personalized Support

Insurance can be complex, and having a broker who takes the time to explain things clearly makes a big difference. If you find yourself constantly chasing your broker for answers or waiting too long for a response, you’re not getting the level of service you deserve.

A responsive broker should:

- Return calls and emails promptly.

- Provide clear and straightforward explanations.

- Keep you updated on policy changes and renewal options.

If you’re tired of feeling ignored or like just another account on their list, switching to a broker who prioritizes customer service can make all the difference.

Easier Claims Process

One of the biggest frustrations people have with insurance is dealing with claims. A good broker acts as your advocate, helping you navigate the claims process smoothly and efficiently. If your current broker disappears when it’s time to file a claim or isn’t offering much support, that’s a clear sign it’s time to switch.

An experienced broker will:

- Walk you through the claims process step by step.

- Ensure you receive fair compensation for losses.

- Handle any disputes with the insurance company on your behalf.

Filing a claim can be stressful, but the right broker makes it much easier. Changing insurance brokers can lead to a much smoother experience the next time you need to file.

Stronger Industry Knowledge and Connections

Insurance policies, regulations, and industry trends are constantly changing. A broker who stays on top of these changes can provide valuable insights and recommendations to keep you well-protected. If your broker isn’t keeping up with the latest developments or fails to inform you about better options, it may be time to look elsewhere.

New brokers often bring fresh expertise and a stronger network of connections within the insurance industry, which can translate into better deals and more innovative solutions for you.

A Fresh Start with a Broker Who Listens

Not all brokers take the time to truly understand their clients’ needs. Some are more focused on selling policies than providing real guidance. If you’ve ever felt like your broker doesn’t listen or doesn’t seem interested in tailoring their recommendations to your situation, it’s a strong reason to consider switching.

A new broker will likely take the time to review your needs, ask the right questions, and make sure you have the best possible coverage at the best price.

Current Broker vs. New Broker

| Feature | Current Broker | New Broker |

|---|---|---|

| Customer Service | ❌ Slow responses | ✅ Fast & helpful |

| Premium Costs | ❌ High & rising | ✅ Lower & competitive |

| Claims Support | ❌ Minimal help | ✅ Full support |

| Policy Options | ❌ Limited choices | ✅ Wide selection |

| Annual Savings | ❌ $0 savings | ✅ $XXX saved |

How to Change Insurance Brokers Without Hassle

Switching insurance brokers might seem overwhelming, but it doesn’t have to be. The right approach can make the transition smooth while ensuring you get better service, pricing, and coverage. Follow these steps to make changing insurance brokers as easy as possible.

Step-by-Step Guide to Switching Brokers

- Review Your Current Policy – Before making a move, check your renewal date, cancellation terms, and any fees associated with switching. Some policies allow you to change brokers mid-term without penalties, while others may have restrictions.

- Find a New Broker – Look for a broker with experience in your type of insurance. Read customer reviews, ask for recommendations, and ensure they work with multiple insurance providers to offer better options.

- Ask the Right Questions – A good broker should be transparent. Ask them about the providers they work with, how they handle claims, and what strategies they use to save you money. This helps you compare their service with your current broker.

- Notify Your Current Broker – Some policies require written notice when switching brokers. Be professional but firm. If they ask why you’re leaving, provide honest feedback, but don’t let them pressure you into staying.

- Transfer Your Policy – Your new broker should handle most of the transition, including paperwork and policy transfers. Make sure they provide updates throughout the process to avoid gaps in coverage.

Questions to Ask a New Broker Before Switching

To avoid switching to another ineffective broker, ask these key questions before committing:

- What insurance companies do you work with? More options mean better chances of getting the right coverage at the best price.

- How do you handle claims? A reliable broker should assist with claims processing and advocate for you when dealing with insurance companies.

- Can you provide references or client testimonials? Positive reviews from other clients can indicate strong service and trustworthiness.

- How often do you review client policies? A good broker should check in regularly—not just at renewal time—to ensure you’re always getting the best coverage.

Taking the time to change insurance brokers properly ensures that you end up with a broker who prioritizes your needs, helps you save money, and provides better service.

Myths About Changing Insurance Brokers

Many people hesitate when it comes to changing insurance brokers because of common misconceptions. However, switching brokers is often easier and more beneficial than expected. Let’s break down some myths and clear up the facts.

1. “Switching Brokers Will Cancel My Policy”

This is one of the biggest misconceptions. The truth is that your insurance policy stays intact even when you switch brokers. The only thing that changes is the person handling your account. Your coverage, terms, and insurer remain the same unless you decide to update them.

A new broker simply takes over servicing your policy, ensuring that you receive better customer support and potentially better pricing. If you’re unhappy with your broker but satisfied with your policy, you can switch brokers without losing your coverage or benefits.

2. “It’s Too Much Work”

Some people assume that switching brokers involves endless paperwork and complicated procedures. In reality, a good broker will handle most of the transition for you, making the process hassle-free.

Once you find a new broker, they will typically:

- Contact your current broker on your behalf.

- Handle policy transfers without you needing to do much.

- Ensure there are no gaps in your coverage.

Most of the time, the switch requires little more than signing a few documents. A professional broker will make the process smooth and stress-free.

3. “Loyalty Means Better Rates”

Many people believe that sticking with the same broker for years leads to lower premiums and exclusive discounts. Unfortunately, that’s rarely the case.

Insurance companies often raise rates over time, and long-time customers can end up paying more than new clients. Brokers who don’t actively look for better deals or renegotiate your policy could be costing you money. A new broker, however, will take the time to compare options and ensure you’re getting the best possible rate.

4. “All Brokers Offer the Same Policies and Pricing”

Not all brokers have access to the same insurance providers or pricing structures. Some brokers work with a limited number of companies, while others have a broader network and can offer more competitive options.

If your current broker doesn’t have access to certain insurers or better deals, you could be overpaying for coverage. Changing insurance brokers can open up a wider selection of policies, potentially giving you better coverage at a lower cost.

5. “I Can Only Switch at Renewal Time”

Many policyholders believe they must wait until their policy renewal date to switch brokers. While switching at renewal may be convenient, you don’t have to wait if you’re unhappy with your broker’s service.

Most policies allow you to change brokers at any time, and your new broker can assist with the transition without affecting your coverage. The key is to review your policy terms and notify your current broker in writing if necessary. If your broker isn’t delivering, there’s no reason to stay stuck until renewal.

The Truth About Changing Insurance Brokers

Switching brokers isn’t as complicated as many think. If your broker isn’t providing the service, pricing, or options you need, making a change could be one of the smartest financial moves you make. The right broker will ensure a smooth transition, better policy management, and potential cost savings—all without disrupting your coverage.